Byd Stock Price 2025 Target

Byd Stock Price 2025 Target. Based on data from marketbeat.com, the stock presently has a consensus rating of buy and a consensus target price of c$278.08. Bajaj broking’s top stock picks for 2025.

Bajaj broking’s top stock picks for 2025. Byd’s efficient business model, product range, and international.

Byd Stock Price 2025 Target Images References :

Source: www.youtube.com

Source: www.youtube.com

BYD 2025 stock price prediction, company analysis & joint ventures, Rmb 13.61 in 2024, rmb 17.85 in 2025, and rmb 20.32 in 2026.

Source: www.youtube.com

Source: www.youtube.com

Secret BYD Insider information BYD will 10X stock price by 2025 YouTube, On january 1, china’s byd announced that it had sold 4.3mn cars in 2024, nearly 20 per cent above its stated target.

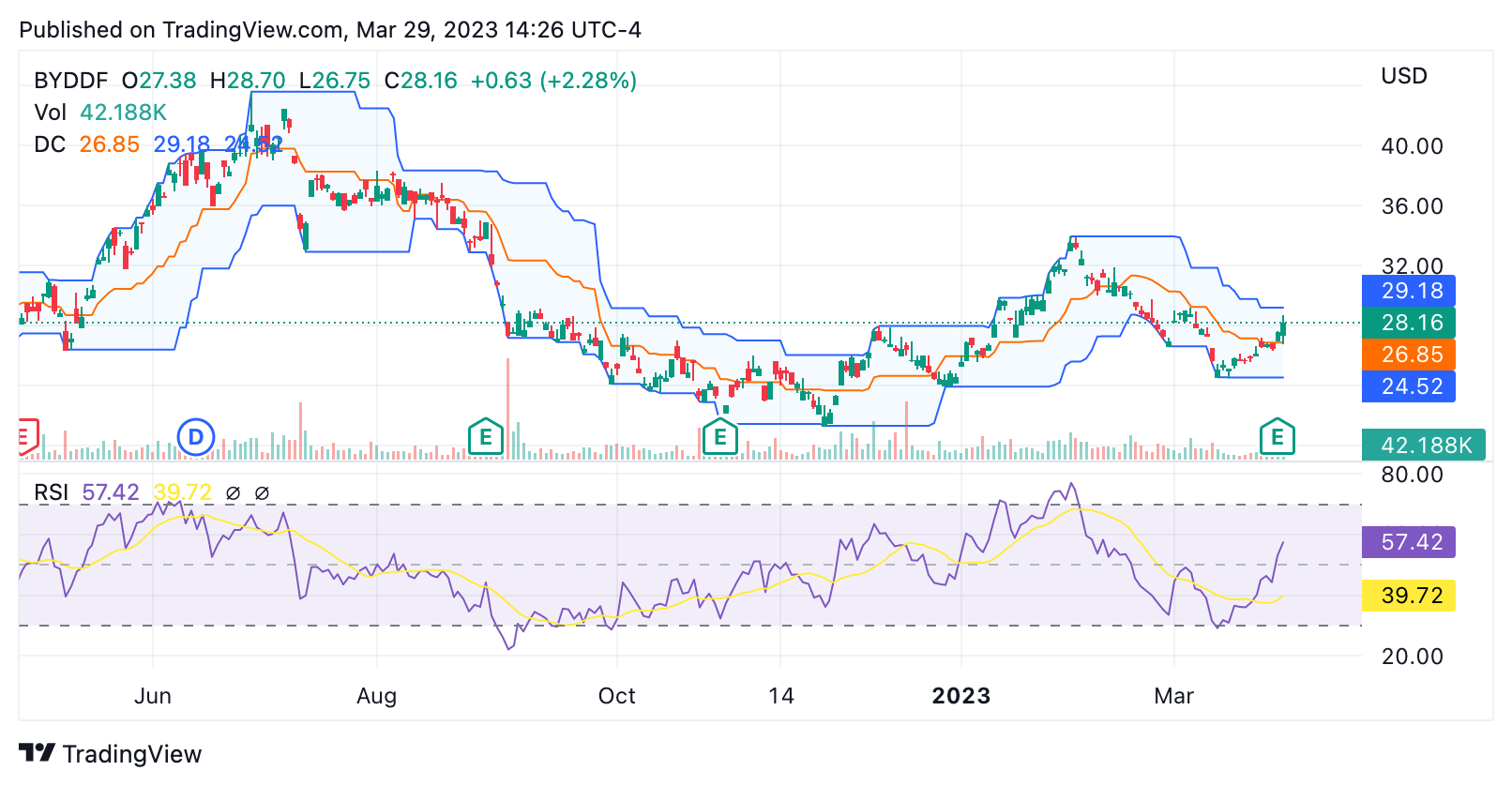

Source: www.tradingview.com

Source: www.tradingview.com

BYD Stock Price and Chart — NYSEBYD — TradingView, This represents an increase of 34.35% from the last closing price of $65.50.

Source: www.tradingview.com

Source: www.tradingview.com

BYD Stock Price and Chart — NYSEBYD — TradingView, Summary of recent analyst ratings and stock forecasts for byd leading up to 2025.

Source: www.tradingview.com

Source: www.tradingview.com

BYD Stock Price and Chart — NYSEBYD — TradingView, Byd stock prediction for tomorrow, near days, this week and this month.

Source: www.tradingview.com

Source: www.tradingview.com

BYD Stock Price and Chart — NYSEBYD — TradingView, Market leader byd's nev sales skyrocketed — up by more than 40% last year to nearly 4.3 million units, far above its internal target of at least 20% growth from 2023.

Source: equisights.com

Source: equisights.com

BYD Stock on the Rise Factors Driving Growth Towards a Target Price of, With a “buy” rating and $260 target.

Source: www.tradingview.com

Source: www.tradingview.com

BYD Stock Price and Chart — NYSEBYD — TradingView, With a “buy” rating and $260 target.

Source: www.tradingview.com

Source: www.tradingview.com

BYD Stock Price and Chart — NYSEBYD — TradingView, Byd has received positive and cautious analyst ratings, reflecting its robust market position and future growth potential, tempered by.

Source: www.tradingview.com

Source: www.tradingview.com

BYD Stock Price and Chart — NYSEBYD — TradingView, Byd has received positive and cautious analyst ratings, reflecting its robust market position and future growth potential, tempered by.