How Much Is My Social Security Taxed In 2024

How Much Is My Social Security Taxed In 2024. When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. The federal government sets a limit on how much of your income is subject to the social security tax.

We use the following earnings limits to reduce your benefits: For 2024, the social security tax limit is $168,600 (up from.

The Good News Is That Social Security Income Is Taxed Less Than Other Forms Of Retirement Income.

When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld.

The Social Security Payroll Tax Wage Base Was $160,200 Last Year.

Social security tax wage base jumps 5.2% for 2024;

Income In America Is Taxed By The Federal Government, Most State Governments And Many Local Governments.

Images References :

Source: www.silive.com

Source: www.silive.com

Increase in Social Security benefits in 2023 How much will recipients, The federal income tax system is. Here are seven things social security recipients, present and future, should know about taxation of benefits.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Paying Social Security Taxes on Earnings After Full Retirement Age, When you calculate how much of your social security benefit is taxable, use the $2,000/month number and multiply that by the number of months to get the annual. How retirement income is taxed by the irs;

Source: what-benefits.com

Source: what-benefits.com

Are Social Security Widow Benefits Taxable, That’s what you will pay if you earn $168,600 or more. This online social security benefits calculator estimates retirement benefits based on your age, retirement date and earnings.

Source: kennethlexy.blogspot.com

Source: kennethlexy.blogspot.com

How much can i borrow if i earn 30000, For 2024, the social security tax limit is $168,600 (up from. That’s what you will pay if you earn $168,600 or more.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Source: ariellewletta.pages.dev

Source: ariellewletta.pages.dev

Annual Earnings Limit For 2024 Abbey, Up to 85% of your social security benefits are taxable if: Earnings above that level are not taxed for the.

Source: www.cnet.com

Source: www.cnet.com

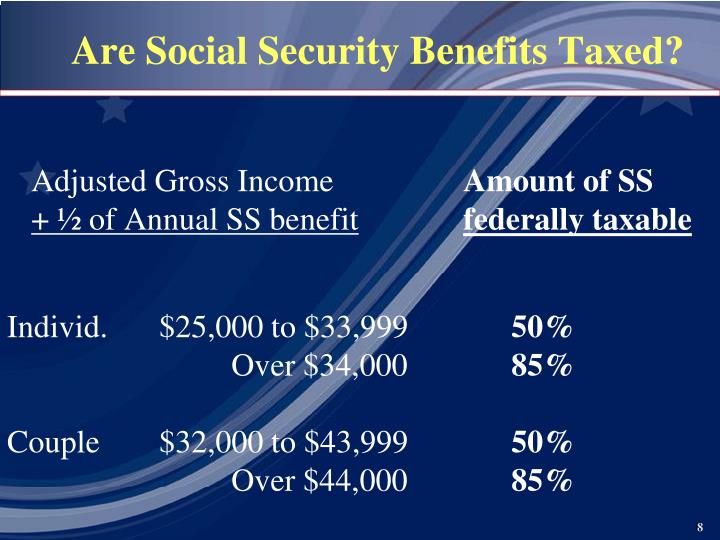

Should Social Security Recipients File a Tax Return?, If you're married and file a joint return, the 50% threshold is at $32,000, and the 85% threshold is at $44,000. As kiplinger reported, the social security tax wage base jumped 5.2% from 2023 to 2024.

Source: www.taxablesocialsecurity.com

Source: www.taxablesocialsecurity.com

Foreign Social Security Taxable In Us, When you calculate how much of your social security benefit is taxable, use the $2,000/month number and multiply that by the number of months to get the annual. Here are seven things social security recipients, present and future, should know about taxation of benefits.

Source: www.retirementnewsdailypress.com

Source: www.retirementnewsdailypress.com

At what age is Social Security no longer taxed? Retirement News Daily, That’s what you will pay if you earn $168,600 or more. The federal income tax system is.

Source: www.youtube.com

Source: www.youtube.com

How is Social Security Taxed How Much of Your Social Security, The federal income tax system is. In 2023, you paid social security taxes on work income up to $160,200.

Source: www.benefitspro.com

Source: www.benefitspro.com

More seniors taxed on Social Security benefits BenefitsPRO, How retirement income is taxed by the irs; The federal income tax system is.

Income In America Is Taxed By The Federal Government, Most State Governments And Many Local Governments.

The federal income tax system is.

The Most You Will Have To Pay In Social Security Taxes For 2024 Will Be $10,453.

The irs provides an online tool to help you determine how much, if any, of your social security income is taxable.